Rethinking Government Pensions

Entitlements are coming home to roost

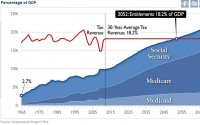

Government entitlement programs are coming home to roost. In June, scholars at George Mason University wrote,

Pension plans operated by state governments on behalf of their employees are underfunded by an estimated $452 billion according to official reports,1 with total liabilities of $2.8 trillion and total assets of $2.3 trillion in 2008. However, many economists argue that even these daunting liabilities are understated. Current public sector accounting methods allow plans to assume they can earn high investment returns without any risk. Using methods that are required for private sector pensions, which value pension liabilities according to likelihood of payment rather than the return expected on pension assets, total liabilities amount to $5.2 trillion and the unfunded liability rises to $3 trillion.2 The ability of governments to pay for the retirement benefits promised to public sector workers runs up against the reality of limited resources.

On December 19, CBS 60 Minutes did a special with Steve Kroft on how public-sector pensions are strangling America’s taxpayers and economy airing interviews with leaders in New Jersey, Illinois, and California, where states are facing bankruptcy if they do not make dramatic changes to entitlement programs. A shift in philosophy of government is required.

For too long many Americans have been operating on a naïve assumption that governments can care for citizens, rather than the truth that governments depend on citizens. Democracies are built from the bottom up. They require self-reliant citizens. A few welfare recipients can be supported if the majority citizens are caring for themselves and paying taxes, but what happens when the majority expects other people to pay for their living expenses and entitlements? The math doesn’t work. Corporate America already learned this lesson.

For the last 20 years or more corporate restructuring that routinely involves the elimination of pension funds has been taking place. However, talk about the elimination of public sector pensions or restructuring Social Security has been a taboo nobody has dared to face, even if the philosophical underpinnings have been based on a ponzi scheme that relies on constant population growth and a guarantee of our own security at someone else’s expense—wishful thinking at best and legalized theft at worst.

There are basically two segments left in our society in which an entitlement to pensions at someone else’s expense exists, government and education. These two segments still operate on the corporate industrial model of the 1940s and 1950s, where unlimited growth and the eternal lifespan of corporations were assumed. While the United States remained an industrial frontier, and our economy was not affected by global competition, this model worked for a while for many U.S. corporations. But since the 1980s, one of the primary causalities of mergers and acquisitions was pension funds. This restructuring was necessary to compete with global corporations that did not factor such corporate overhead into the cost of their products.

Government pensions at all levels have been paid for by tax dollars, and after taxes could no longer be raised to support government entitlements, governments have attempted to borrow money to cover these obligations; or they have sought to get bailed out by higher state or federal governments. Ultimately, passing obligations up to the federal government with debt-financing by printing money to cover entitlements is a ponzi scheme. Unlike borrowing money to finance an industry that creates more wealth than is borrowed, such borrowing simply redistributes the principal and accumulates debt on the interest. This created a house of cards that has now begun to collapse.

Incentives to transfer government plans to private retirement insurance

The United States was designed as a government of the people. It was set up as a limited constitutional government that expected people would care for themselves. In my book Life, Liberty, and the Pursuit of Happiness, Version 4.0, I documented how this philosophy was gradually undermined over a period of more than 150 years, with the (unconstitutional) Federal Income Tax creating a large pool of new money in Washington, which enticed special interests, lower governments, and Washington bureaucrats all to pass unsustainable legislation. Social Security was one of the earliest in a long line of programs that began to discourage personal responsibility for retirement.

While government pension programs worked in their initial stage, their long-term unsustainability has now hit governments with the predictable backlash. These programs need to be phased out immediately and replaced with programs managed by individual citizens or they will collapse, leaving governments at all levels bankrupt, and leaving older people who are vulnerable and dependent out in the cold, like their counterparts in the Soviet Union, when that system collapsed in 1991.

We can avoid a similar calamity if we transfer pensions and entitlements to private plans, managed by individual citizens. However, we cannot leave private individuals on unsound financial plans proposed in the Bush era and criticized by Democrats as “putting your retirement in the stock market.” Most people know that stock markets are too unreliable, and that if private pensions were unregulated, many people would put retirements into risky and irresponsible plans. We would again end up with large numbers of elderly citizens in situations like the 1930s when Social Security was originally implemented.

Make Private Annuities Mandatory

Private annuities already exist and many people use them to supplement social security in their retirement. Why not simply make them mandatory? If every person has a viable retirement program, then governments will not have to watch entitlement programs bring them into bankruptcy.

How would such annuities be enforced? The method would be similar to that used for proof of car insurance before license plates are issued. Each year when income taxes are filed the citizen would need to show proof of an annuity policy that contained a payout at a minimum of what social security would pay.

All new entrants to the US workforce would be required to adopt the private retirement system, and all existing workers could be offered the opportunity to abandon social security and substitute it with a personal insurance plan.

There is a precedent in exempting some Amish groups from Social Security if they have an alternative retirement plan in place in their own community. Let’s only get the government involved when people fail to care for themselves.

Local Governments and Corporations could Pay into Private Plans

If local governments or corporations want to contribute to employee retirements, they should be allowed to pay into private employee plans for employees, but they should be forbidden by law to establish new plans that they themselves administer. Originally the U.S. founders made it unconstitutional for the U.S. government to engage in social welfare, and for good reason; such programs undermine sound government. However, if society is structured so as to encourage individual citizens to behave responsibly and plan for their own retirements, then such a burden on governments can be avoided.

We need a paradigm shift that places responsibility back into the hands of citizens, without the laissez-faire attitude that allows citizens to behave irresponsibly and later become a public burden. In this way governments can maintain a safety net without providing entitlements to everyone on a ponzi-scheme philosophy. Chile has adopted such a system and is being watched carefully. Many Chileans still fall through the cracks because they do not earn enough income to secure a minimum retirement. The World Bank has suggested that the government create a safety net for these people through VAT taxes.

As I explained in my book, modern societies are divided into three components, culture, economy, and government. When institutions in one of these spheres try to take over the role of one of the other spheres, we inevitably have either poverty or tyranny, or both. Modern bureaucratic governments do not have the same incentives as communities, churches, or businesses, and they are not equipped to solve social problems like providing for retirement. However, governments can protect citizens from causing social harm by creating laws that require citizens to either prepare for their own future, or accept a government subsistence plan by force of taxation instead.

Further, in an ideal situation, the taxing authority would be the county or state, because personal retirement, as other social programs should follow the principle of subsidiarity or, “the greatest responsibility to the lowest possible level.” Incidentally, following this principle leads to greater happiness. People are happier when they live their own lives rather than accepting some institutional master’s plan for their life.

Lower levels of government, municipalities, counties, and others that are not required to provide pensions but want to attract employees could begin this transformation immediately and avoid future insolvency. By paying into private employee annuity or retirement insurance accounts, they would not be tying up future budgets with past entitlement obligations.

” … states are facing bankruptcy if they do not make dramatic changes to entitlement programs. A shift in philosophy of government is required. We need a paradigm shift that places responsibility back into the hands of citizens, without the laissez-faire attitude that allows citizens to behave irresponsibly ” G.A.

As it seems two categories of change are being called for, a shift in philosophy of government to avoid insolvency and a paradigm shift in the attitude of citizens who behave irresponsibly. Clearly, elected representatives in government have acted irresponsibly by enacting legislation that promises to be all things to all people. More often than not, that is how politicians gain the majority of popular votes by making irresponsible promises. Who is to blame for the failed and crumbling state of affairs, a majority electorate that is ill informed and unskilled in public management, or the elected representatives who by objective standards are well educated and highly qualified, nevertheless follow the whims of the masses ? An unskilled and uneducated electorate acts out of ignorance. However, the elected officials who know better act against and contrary to better judgment and sound principle. In this light, representative democracy is unsustainable as a form of modern governance when sound judgment and natural principle are ignored by the weight of popular demand. It is a recipe for self defeat and disaster. As a nation, it must cast off its illusions and rediscover the laws of interdependent reciprocal norms set by public principles. The principle of subsidiarity or, “the greatest responsibility to the lowest possible level ” is the institution of the extended family as the building block of a just society. A ideal philosophy of governance ought to evolve from the the paradigm of the family that is led by its wisest members. In time retirement planning will return to the foundation of interdependent families and their shared resources. Public policy should move in this direction to have families care for themselves and reduce the burden on government entitlements. ” Incidentally, following this principle leads to greater happiness. People are happier when they live their own lives rather than accepting some institutional master’s plan for their life. ” This fundamental change will take years to enact through a deliberate effort and leadership. Leadership that must come the people who have sound judgment and adherence to principle that can stand up to the whims of irresponsible selfish interests. Inevitably, an urgent confrontation will have to take place between the defenders of a failing status quo and a new paradigm of absolute reciprocal norms of behavior of a just society.

As always, Gordon’s scholarship is excellent. Unlike my blog, which is meant to provoke, to stimulate and to entertain, as well as to educate in a quick, “cute” and relatively superficial way, Gordon is much more serious. I commend him for that.

There is no question that public pension funds make unwarranted assumptions. For example, California’s PERS – the $200 billion state retirement system to which I belong – assumes that it will average 7.5% per year return on its investments. That’s wrong.

However, I don’t see how privatization is such a panacea. Being subject to the vagaries of the stock market could be a killer to millions of retirees. Americans have lost a huge part of their retirement investments (TSA’s, IRA’s, etc.) since the Dow Jones went down from 14,000 to 7,000 (to go back up to 11,500 at the present time).

As to Social Security and Medicare, these are totally salvageable: (1) you continue to gradually raise the age at which people start qualifying for benefits. Since life expectancy has increased, it is logical that fully paid retirement should also be moved up. (2) you increase contributions (3) you decrease benefits.

All three of these steps also apply to State pensions. The question is not whether or not we should have public pension systems, but how generous these should be. Obviously we can’t sustain current levels. But this doesn’t mean that public pension and medical insurance systems which have vastly improved the life of the elderly and the retired for nearly a century in the entire Western World should be scrapped. Privatization would signify a return to the dark “Dickensian” conditions of the past.

Tom must have missed what I wrote:

“However, we cannot leave private individuals on unsound financial plans proposed in the Bush era and criticized by Democrats as ‘putting your retirement in the stock market.'”

I think the “private retirement = stock market” mantra is so ingrained that people can’t get beyond it.

I tried to be clear, that what I recommend is not subject to the vagaries of the stock market. INSURANCE, which I recommend, is like banking and actuarially sound, based on premiums like banking is based on interest. There is no speculation in it. There is actually much more speculation in our government plans than in insurance, because Social Security is neither held to as high accounting standards, nor is it as efficient as a competitive market, suffering from greater abuse, and mismanagement as a political football.

The ironic thing is that many governments are apparently investing pension funds in risky stock markets. Tom wrote “the $200 billion state retirement system to which I belong – assumes that it will average 7.5% per year return on its investments.” This is why I agree with Tom that putting retirement in the stock market is bad, and another good reason to get them out of the hands of government. You never know what the next bureaucrat will decide to do with your money. Governments simply aren’t regulated the way the insurance industry is.

Although the government plans are less risky than the stock market. Look how people like Ben Bernanke and others who understand our financial system plan for their personal retirement–they buy annuities.

Gordon; you know that none of these problems have answers as long as we keep borrowing funny money from the FED to fund them. We can fu nd most anything as long as we creat what we spend instead of borrowing it.

We cannot borrow our way to prosperity,–only to bondage. Key words we have forgotten–Leige, Human Resource, colateral. All these are tided to Usery.

Usery never was prosperity.

Charles, by making everyone’s plan a private annuity, each person’s pension would be based on his own contribution. The idea that my pension be paid for by my children is irresponsible. The fact that my pension be paid for by 8 people is exploitation and a form of imposed slavery. It goes against the moral law. There are only two ways such an immoral system can work. (1) It depends on an exponentially increasing population that the land cannot sustain, or (2) it requires some form of ponzi scheme like the fed printing more money, which is what the Russians tried. Neither solution is long-term sustainable. The first solution, implemented under Roosevelt, worked for a couple of generations when we had families of six children and large immigration. Then we began the second approach which guarantees economic collapse, as happened in Russia in 1991, when the Ruble that was about $4.80, declined to about 450 rubles per dollar. Pensioners still got their pension, it’s just that a month’s pension wouldn’t buy a loaf of bread. That is where our current system is headed unless we reform it.