Ending U.S. Pension Fund Bubbles

There is a long history of economic bubbles in the United States going back to the Mississippi bubble in the 18th century. Bubbles are caused by speculation in which people grow wealthy by some scheme in which later comers to the scheme fund earlier members. Bubbles are all theoretically unsustainable and eventually cause a crash that hurts the last and widest ring of speculators. The role of government should be to provide a rule of law that makes ponzi schemes illegal as many ordinary people get hurt when bubbles burst. Many defined benefit government pension plans qualify as such schemes.

Unfortunately in the United States the budgets of both state governments and the federal government have become based numerous ponzi schemes. Governments, while making an effort to punish promulgators of ponzi schemes like Bernard Madoff in the private sector, have failed to curb or prosecute the creation of their own schemes. They have been jaundiced by their own power to tax and spend. And, they have been swindled into promoting such schemes by special-interest campaign contributions.

While there are many forms of government ponzi schemes that need to be corrected, the concept of defined pension fund benefits is the current bubble bursting. It is been playing out graphically on television in the standoff at the Wisconsin capitol as I write this article. Let’s begin with a primer on bubbles so that we can better understand the pension-fund scams that have been sold to school teachers and others by union leaders and corrupt or gullible politicians.

One necessary political and economic reform will be to understand and outlaw the creation of government ponzi schemes, for the role of government is to provide rule of law that protects people and creates a genuinely fair and democratic economic playing field, so we do not have such bubbles arising and causing social chaos in the future.

The Anatomy of a Bubble

The originators of a bubble and early joiners have a chance at making a lot of money off of the hopes of the later joiners, who will lose. A common form of bubble can be illustrated by the mail scams in which the originator sends out a letter, saying ,

You can get rich by just forwarding this letter to six people you know. It is unbelievable, but true, add your name to the bottom of the list and send one dollar to each of the six people above your name. Then send on this letter to six people you know who want to get rich. Then sit back and watch the money come in the mail.

If everyone played the game, the person on the top of the list will theoretically have a possibility of receiving over $470 billion dollars when they are on the top level, $60 million when they are on the second level, $46 thousand on the third level, etc. Of course, this will not happen in actuality because the sixth level will exhaust the entire population of the United States and many people will receive the letter several times. These mail schemes are generally prosecuted as mail fraud.

Multi-level marketing is a pyramid scheme in which participants sell genuine products like soap, vitamins, water filters, or air-purifiers. In this case, the salesmen at each level get a percentage of the sale of the product with the inventor of the product getting rich and purchasers simply paying an inflated price for their product. Such marketing schemes are not illegal, unless joining them and becoming a “salesman” requires a high fee, because in this case the originator is getting rich on the fees and not the sales of an actual product. But multi-level marketing businesses eventually collapse in a competitive market. This is because if the product becomes widely desired, a large company like Wal-Mart will begin selling it without the inflated cost of sales and it may become available for less than half of the price of the pyramid corporation.

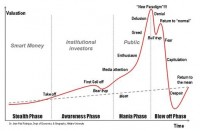

In a ponzi scheme like Madoff’s or the Mississippi bubble, the purchaser gets a stock certificate or some other document that represents ownership in a corporation that is said to me making money. Those investors in on the ground floor, or the third level provide testimonies about how much profit they have made as they sell the idea to the general public. This convinces others to join. In the end, the money invested far outstrips the value of what it is promised to represent, and when people finally realize that they are part of a bubble about to collapse, they panic and sell. Sometimes, the panic causes immediate collapse, other times opinion leaders intervene and stop the selloff with promises or bailouts that claim conditions have returned to normal when they haven’t, as indicated by the false normal on the decline in the chart above.

Defined Benefits and the Pension Fund Bubble

The main reason that many government pension funds have become bubbles is that they are based on theories that are ultimately speculative and have proven faulty. One of the main mistakes has been the concept of a defined benefit that is thrust on the next generation to pay for. I discussed in a previous article how corporations went through this process of pension reform many years ago and switched from a defined benefit to a defined contribution.

A defined contribution only obligates an employer to pay toward an employee’s pension while the employee is working. This contribution is added as a tax-deferred payroll benefit in the form of a 401k, 403b, or other retirement account. When the employee leaves or retires, he maintains control over his own retirement account. He may invest it wisely or not, but the employer is not left on the hook for a future obligation.

Democratic governments are particularly susceptible to passing off obligations to the future because elected terms are generally short by comparison, and promises made for election today can be passed off to the future. In recent decades, many politicians, particularly Democrats, have been elected by public employee unions that have contributed heavily to political campaigns if the elected official promised to provide guaranteed benefits to retirees from public jobs.

Today President Barack Obama and many recently elected officials have come in at the third or fourth level of the defined benefit government ponzi scheme. Generally those running as Democrats, like my own governor Mark Dayton, have promised to continue to prop up the existing government pension schemes even though they are unsustainable. On the other hand, Tea Party candidates, voted in by the general populace that now realizes this is an unsustainable bubble, feel a mandate to reform government pensions so that they are sustainable, and not imposing an unethical burden on the next generation.

Creating Economically Sustainable Pension Laws

Ultimately the pension bubble must be fixed by laws that prevent the type of political behavior that caused the bubble. Defined pension benefits cannot be legislated with any certainly because we do not control the future. They must be declared illegal. We can control what we contribute to a current employee’s retirement fund, by adding a benefit to their wage. A defined benefit however places an obligation on our children and is a form of child abuse. It is simply wrong and immoral.

The only way that a defined benefit can be logically supported is if it comes out of an existing fund. This is the way annuities are constructed. When benefits are withdrawn at a defined rate from an existing fund, they do not come out of the sweat of our children. However, those pension funds that are failing have been promised by non-existent funds to be created by the next generation. In some cases these funds have been based on 8 percent compounded interest, even though present savings accounts pay only 1/2 percent interest or less.

Such fictitious future funds from which public employee pensions will be paid are a classic ponzi scheme. They are no less speculative than gambling in casinos or betting in the stock market. We are now in the third or fourth generation of the scheme in some cases. The fear in teachers demonstrating in Wisconsin is a result of a panic, not unlike the run on the banks in the 1930s. Governments should try to honor the unsustainable commitments to teachers and other public employees in some fashion, but just like private-sector defined benefit plans that were unsustainable, they must be converted to something of a sustainable form before there is a complete bankruptcy.

Public employees should realize that, like for retirees of most private corporations, pensions will need to be restructured to something sustainable, or they may cause a systemic collapse that will leave them without any pension at all. They must realize that they have been promised a future based on a ponzi scheme, but they still have a chance to convert it to something sustainable. In the private sphere, we saw those employed by Enron lose everything. On the other hand, many corporations restructured and converted funds into sustainable pension funds that delivered less than originally promised, but something that was no longer based on speculative theories of unlimited future growth. We cannot undo the past, but we can learn from our mistakes and prohibit laws that promote public pension-fund ponzi schemes in the future.

Making a break from the past and learning from our mistakes will take perhaps another generation or two. Retirement pension funds were intended to reward the steady and long term contributors to the success of a business or firm. Pension funds would include savings from the workers and an employer’s percentage of matching dollars. Along the way it became clear that retirement funds could be invested and not just left to sit idle. Naturally, invested retirement dollars would take on varying degrees of risk. Companies that fell into misfortune would stop contributing matching dollars into worker’s retirement accounts. Surprisingly, pension fund liabilities of some bankrupt companies were taken over by the government. In this way taxpayers would eventually become responsible for the retirement promises of bankrupt private enterprises. It is interesting how the government got into the business of insuring the risks of private enterprises. Perhaps at the time FDIC made a lot sense. However, in light to the recent 2008 fiscal crisis and the subsequent $billion dollar bailouts, the role of government as the insurer of private enterprises has come into serious question. I hope this isn’t confusing. There is too much history to cover in a short posting. The idea of insurance seems to be at the heart of how the government got into the business of social security insurance – public and political management of citizen’s statutory retirement savings. Furthermore over the years, the politicians transformed social security into a wide range of entitlements. Finally, these entitlement promises and costs have become so great, they will endanger the solvency of the country in about a decade. This is the stark result of many decades of failed leadership in Washington DC. If social security were an airplane then it is in a death spiral heading for a crash landing. The rich and wealthy are heading for the exits with their parachutes. The remaining passengers seem strapped in their seats as the airplane makes its descent. The majority of taxpayers are feeling helpless in the situation. Can a committee of passengers simply rush the pilot’s cabin and take over the controls and avert disaster? Needless to say, there are a lot of prayers being said in the coach seating section. Strangely, many passengers haven’t a clue of the danger. By analogy, the US situation can be compared to a damaged heavy bomber returning from a mission over enemy territory. Engines are smoking from enemy fire, there are casualties aboard and the fuel is leaking. The question is whether this plane make it back home or not. The captain and crew have to make a life or death decision to jettison everything possible to lighten the aircraft to keep flying; and, hopefully make it back home. Every pet project including the kitchen cabinet might get tossed overboard in order save this nation. So, what are they thinking in the pilot’s cabin?

Robert, you analogy is vivid. While I have many problems with the way Social Security is structured, I believe it has a well-intended purpose and that it can be restructured and saved.

It is important to distinguish between Social Security and two types of government pensions, one being “defined benefit” and the other being “defined contribution.” The defined benefit pension is the type that is based on a ponzi scheme and ought to be outlawed.

The problems with Social Security are twofold. First of all, it should not be the government that manages this for everybody, but just for people who can’t prove they have their own plan. The government’s universal plan encourages people to consume now and not plan for the future because they can fall back on Social Security. This is bad from a moral standpoint, as well as an unnecessary government expense of administrating such large amounts of money.

However, the Social Security system is based on the idea that it will pay out from an existing fund, not from the next generation. The problem here is that the “fund,” while it exists on paper, has been stolen from to the tune of over $3 trillion dollars, thereby putting an actual burden on the future.

The solution will be to allow all responsible people to invest in private funds, proven to exist and well regulated. Then those people who cannot prove such funds can be taxed and go on the government’s plan.

“… government’s universal plan encourages people to consume now and not plan for the future because they can fall back on Social Security. This is bad from a moral standpoint … ”

As it seems a perfect universal safety net that would catch … everyone who falls due into misfortune … would encourage some people to act irresponsibly. So, the question, what is the moral responsibility of the so called ants who prepare in advance for times of scarcity, towards the so called grasshoppers of the world? For some advanced civilized nations this remains a highly debated question with wide ranging moral and ethical implications. A national safety net is a social compact between citizens and providers. As the provider, the government managed safety net cannot be implemented without some understanding of limiting conditions. America’s social security is a safety net that has over reached and expanded beyond reasonable limits. It’s been fraudulently managed and it’s unsustainable. Transforming or restructuring the social security system is like trying to reform the IRS, the Federal Reserve or the

DOE. According to the oracles, a crash landing is inevitable and there will be casualties … in the Socratic sense. No one wants to bear the ultimate burden of public foolishness. In the case of Socrates , personal fate was placed in the hands of … the unknown will of divinities. America is on its way of the Athenians unless we can evoke the will of greater Gods. Our children will continue to contribute to SS while knowing it is a failing program. It would be prudent to instruct them to have alternative plans for saving for a rainy day and for future retirement. Those plans should include the admonishment to stay close to ways of Nature and self sufficiency. Finally, to make sure to have a good and trustworthy accountant.