Anatomy of a Government-Caused Bubble

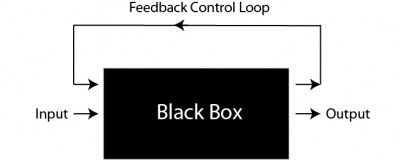

Cybernetics is a simple way to analyze systems of any type, and can be used to graphically display government tinkering with normally stable social systems. The black box is the simplest way to describe inputs, outputs and feedback without having to understand the complicated workings of what is in the box (e.g., Congress). Here is a simple diagram:

In diagram above, you could imagine the black box as a thermostat. The input is electricity; the output is a signal to turn on the heating unit. The feedback loop is a temperature sensor that kills the input signal if the temperature becomes too hot or enables it if the temperature becomes too cold.

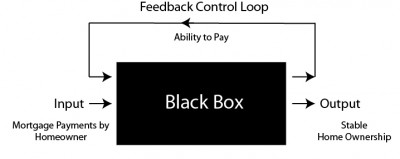

Next we can view a diagram of stable home mortgage system:

In this diagram, we see that home ownership is regulated by the ability of home buyers to pay their mortgage. It is determined by analysis of past payment histories and defaults and is a criterion established by lending companies. In this type of system the housing market will grow or shrink in a slow and stable way based on the number of people wanting homes and their ability to pay.

Now we will look as what government home loan guarantees do to the system:

Before the recent housing bubble, Congress passed a law saying Fannie Mae would guarantee mortgages, changing the normal feedback control loop to a “stuck on” position. They did this to try to influence the system so that more people would buy homes, and keep construction jobs booming. This incentivized lenders to lend mortgage money to people who could not pay. The result was the creation of artificial demand that raised prices artificially, but it could not be sustained. Instead of protecting homeowners, the government caused them great hardship, betraying its legitimacy, by causing them to buy something they could not afford, and a collapse of values that caused short sales and people moving back into parents’ paid-for homes.

This is a clear example of how a government can pave the road to hell with (stated) good intentions. When Congress subsidizes something, you get more of it. In the case of the housing bubble, the guarantee to lending institutions that Fannie Mae would cover defaults on mortgages changed the feedback control loop from something stable to a control loop that kept the mortgages flowing and an oversupply of mortgaged housing to develop. This was equivalent to holding open the throttle on an engine until it blows up.

There was a lot of lobbying, rhetorical justifications, and fuzzy logic that went on inside the black box called Congress. But you don’t need a law degree to understand what was done. You can eliminate all the rhetoric you hear from political parties and special interests if you can analyze it with a cybernetic diagram. You can do this with pension funds, health-care systems, or any other form of government intervention into a system.

In reality, the market is a natural regulatory system. It is far more responsive and self-corrective than a government, because a government by nature is formed by law and doesn’t change until new laws are passed.

Government has a legitimate role in intervening if the market system somehow breaks down, as in the case of a monopoly on home lending by a single bank.

When you look at recent legislation both in the Federal and State governments, you can find many laws that are causing bubbles. Perhaps we ought to have proof they will cause cybernetic stability before they are passed or the Supreme Court could be given the right to strike down such legislation.

I think that nearly anything that government does, since it is by force of law with threat of fines and imprisonment, means that it will cause distortion of the marketplaces.

You are correct in what you have written here, but it is actually worse: the government not only guaranteed the loans, they mandated that if the government controlled and regulated entities wanted to be in business to make good loans, they had to, by law, show that they were also making risky loans. To do that, the lenders had to ease the requirements for loans, producing by the 2000’s a situation where people could have no money down, and have no documentation of income or wealth necessary to pay it and still get a loan… and people would do it, because the housing bubble made it look like the increase in housing prices would never end, so if you borrowed $400K today, next year you would make at least $32K in home value. Who would want to pass up the opportunity to make $30,000 from nothing?

Non-government regulated entities like Countrywide just jumped into the business climate set up by the government, and their real crime was that they competed well in it.

You would think they could learn from their mistakes. In May Minnesota approved a similar program for loans to small businesses. A guarantee of 70 percent of the value of the loan to lenders. Now we will face another bubble.

http://www.savethisnation.org/apps/videos/videos/show/2394707-mortgage-crisis-skit-pulled-from-snl

This skit about the mortgage crisis and the bailout is one of the most truthful things I have ever seen from Saturday Night Live.

Yes, there is more accuracy in this than in many mainline media reports because they were able to portray motives of various characters in the drama. However, all these participants were players AFTER the legislation occurred. It would have been better to portray the congressional debates that caused the loan guarantees.