Republican Tax Plan does part of the Job, Democrats will need to do the Other Half

The Republican Tax Bill Makes some changes to the tax code that will help promote jobs and economic growth and reduce taxes on the middle class. However, it fails to address serious loopholes and flaws that serve wealthier people and investors. It also fails to balance the budget. These are things the middle class will need to elect Democrats to do in a future session.

The Republican Tax Bill Makes some changes to the tax code that will help promote jobs and economic growth and reduce taxes on the middle class. However, it fails to address serious loopholes and flaws that serve wealthier people and investors. It also fails to balance the budget. These are things the middle class will need to elect Democrats to do in a future session.

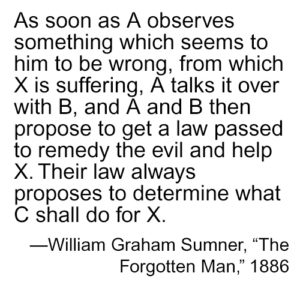

Weaknesses in the U.S. political system have allowed special interests behind both political parties to serve themselves at the expense of the middle classes. The Trump election was a signal that the middle classes could not continue to bear the bulk of the tax burden at the expense of the rich and the poor.

The Pros

- Raising the standard deduction and reducing itemized deductions. This will generate a tax break on the struggling low-middle class workers that have a family income of $75,000 and lower. When the income tax system was designed in 1913, it’s purpose was to be a tax on wealth above the amount needed for basic food, clothing, shelter, and education. Increasing the standard deduction is just because people who have been at these lower levels have been prevented from accomplishing things the welfare system gives to people who do not work. Itemized deductions tend to be carved out favors that help some individuals more than others. Raising the standard deduction is more just than such favors.

- Reducing the Corporate Income Tax Rate. Corporate taxes punish production and the economy. They are like taxing drinking water and blood. For the healthiest economy, they should be zero. There should be no need for not-for-profit corporation status because it is bad policy to tax any corporation. What people are emotionally against is using the corporate budget for individual’s luxuries. But taxing corporations doesn’t fix that problem.

- Luxuries purchased by corporations can be taxed by sales taxes.

- Reducing government favored status and monopoly status and reintroducing market competition will cause companies to compete to the point there is little profit to buy luxuries, and prices of products will be lower, benefiting consumers.

- Corporations currently buy luxuries because they are more desirable than giving the money to the government in taxes. They become a form of shelter from currently bad tax policy. When there is no tax benefit for a corporation to buy luxuries, they will quickly end.

- Taxing all individuals who take money out of corporations, will generate more tax revenue than taxing the corporations. This includes taxes on dividends based on the same rate as other personal income. Lower taxes on dividends than personal income is immoral because it taxes income received from other people’s labor at a lower rate than one’s own labor. This is a form of slavery.

- Reducing tax filings to postcards. This is a form of service of a government to its people. The government should help make life better for citizens, not overburden or exploit them. Thousands of needless non-productive jobs are caused by complicated tax filings. These include massive numbers of IRS employees as well as private tax preparation firms. All these types of jobs are a form of parasitism on the economy and the middle classes. They are a form of false “trickle down” economics that cost two dollars for every dollar gained.

- Eliminating itemized deductions. Itemized deductions reward specific behavior. Some deductions are for genuine service to others, but most are often questionable:

- They reward borrowing money to go to college (a form of child exploitation).

- They reward higher tax states (they reward theft).

- They reward buying bigger houses (they encourage waste).

- They reward giving to charity (many people give to their own charity, which becomes subsidized socializing.)

In summary, the current tax bill contains some positive provisions that will help the middle-class and the economy. However, it also has many problems:

Cons

- Fails to Correct Artificially low dividend income. Taxes on dividends are taxes on incomes earned from investing wealth. As a rule, dividends are paid to wealthy people who earn money off of the backs of other people’s labor (corporations and their workers). It would be more just to tax the sweat of one’s own labor less than the sweat of another. The current corrupt system enables investors to pay less on their income than workers. This is a form of slavery. If dividends are taxed differently than other income, it should be higher, not lower, to deter taking advantage of others because one has wealth.

- Fails to balance the budget. Neither political party has been able to run a balanced budget in the current century. This is because gaining something for special interests supporters is more important than serving the society as a whole. A sustainable society requires a balanced budget, or the future generations pay for the selfishness of the current generation. It is immoral for parents to exploit their children but, as a society, we are doing just that. The Republican party used to stand for responsibility. It is only right that the special interests controlling a political party should sacrifice for the sake of the whole when they cannot balance the budget–like a parent sacrifices for a child. In this case, Republicans should make up the difference by a progressive tax on the rich.

- A Federal Income Tax. The initial concept of the federal income tax was that it would be a tax only on wealth beyond basic needs. The U.S. Founders believed that States should pay apportioned taxes to the Federal government, making it a Federal system. If the individual states competed to determine how best to raise their apportioned taxes, there would be an incentive to develop the most efficient states. The current system is an end run around the states and fails to discipline either the Federal government or State governments. Over the years many other concepts important to the founding have been ignored and circumvented, allowing undesirable special interests to manipulate government at the expense of the citizens. We have a form of structural exploitation of citizens by both levels of government. Government discipline and reduced structural violence would be encouraged by eliminating the Federal personal income tax and moving to a system of apportioned taxes on states.

- A progressive income tax is most just. People with more wealth and property have more to protect. Because, in principle, the primary role of the federal government is to protect life and property, paying a protection fee for each unit of wealth being protected is a form of justice. It is the responsibility of the ruling party, and the ruling class, to take care of the country it runs, not for leadership to force poorer people to care for them. Not to have progressive taxation is a form of welfare for the rich, paid by the middle-class workers.

In summary, the current tax system contains many provisions that create structural injustice. The special interests that control both parties are unwilling to put the society as a whole ahead of their own interests. Historically, this situation has made both parties untenable and causes a see-saw oscillation between parties every election or two as they are elected to correct the most egregious exploitation of citizens by the party in power.

Until the 21st century, the country was young enough to not have overburdened the middle classes with either excessive support for the wealthy or the irresponsible. But the Trump election signifies a failure of the entire system (the establishment wings of both parties) to come to grips with the structural oppression of the middle classes.

The current tax bill does maybe 10 percent of what would be required by an ideal overhaul of the tax system:

- Reduce corporate taxes to zero, and eliminate the need for even having entities called not-for-profit corporations.

- Tax all individuals based on their total earnings, without giving any favors to what state they live in, what charities and social activities they support, or what they borrow money for.

- A balanced budget should be mandatory, with progressive taxes on those earning more than a basic living, say $50,000 per year.

- A system that gives those on welfare less than the lowest wage-earners not on welfare–providing an incentive to become a productive citizen.

Thank you Gordon for this thought provoking article. At least in Pennsylvania where I live, where several moderate Republicans are resigning in 2018, I fully expect many Democrats to fill in those seats.

Thank you Gordon! Your clear thinking is so comforting, and your humility makes dialogue possible. Because I worked for a nonprofit, started a nonprofit, and contribute to nonprofits, and because I’ve done fundraising for nonprofits, I have a strong feeling that this type of corporation really is needed. The type of services they provide are unsustainable without the help of many donors. And our civilization will not survive without the work they are doing. But your other ideas are stimulating and helpful, and your voice deserves a larger audience, it seems to me. I’m going to share this article you wrote, but I wish I were sharing you as a person, and not only with a few friends, but within the general discourse of today’s world.

Kristin, First, one way to spread the discussion is to share the post on any discussion groups you think would be interested. Second, non-profit status certainly should get more discussion. There are a couple of different issues. If no corporations paid taxes, then a charitable organization would not need the exemption for itself to avoid paying taxes. The reason would be to offer a donor a deduction to encourage charity. That has to be closely policed if it exists. I have attended many extravagant social events funded by nonprofits where someone could gather important people around him and nourish his ego in the name of peace. No actual charity takes place. Same with churches. A bunch of friends can throw social events and deduct them from their taxes because a church pays for them. Real charity would take place if you paid your taxes first and then helped other individuals after contributing your fair share to your country.