Converting Public-Held Pension Funds to Private Accounts

Traditional Corporate and Government Pension Plans are Unsustainable

Traditional Pension plans in which a government entity or corporate entity self-funds and manages pension benefits have outlived their usefulness for retirees. Such plans, intended to pay out guaranteed retirements, have proven to be too speculative or poorly managed. Many plans were miniature ponzi schemes that assumed the entities would have continual expanded growth or eternal life. In the 1940s and 1950s when America was experiencing rapid growth and industrial development, corporate and government managers frequently promised employees healthy retirements and encumbered their institutions with future obligations that eventually could not be funded.

Not only were corporate and government pension plans unsustainable in the long run, they were often implemented as a way for corporations and government bodies to accumulate a pool of employee cash that they could borrow against or invest in the stock market, hoping to make a healthy return. This type of bureaucratic greed-based speculation has often proven more disastrous for retirees than more modest private accounts would have been.

Traditional “Guaranteed” Plans were Speculative

The traditional rhetoric of industry and government officials had been that their pensions will provide guaranteed benefits. However, such claims have been hard to keep in the long run and were either naively made or knowing deceptions. Can you guarantee the existence of the B&O Railroad, of Studebaker, of Enron, of Unisys or the thousands of other corporations that have arisen and fallen? Can you guarantee that the company will have a pension fund manager that will invest wisely and profitably, even when the stock market retreats? Since the 1970s corporations have been moving away from such pretensions as traditional pension plan systems brought them to their knees.

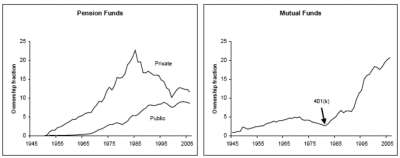

Most traditional corporate pension plans have been scrapped as mergers, acquisitions, foreign competition, and other factors have caused economic restructuring in which pension plans have been converted, reduced, or eliminated. Today most retirement funds offered by corporations are 401k plans managed by financial institutions. Contributions are paid in while an employee is working for the company, and when the employee leaves, his account goes with him and the employer has no further obligation to him. Many corporate employers contribute to pension funds, but they give a fixed amount while the employee is working and encumber no obligation when he leaves, no debt is paid forward to the future.

Many government pension plans followed the old failed industrial model. In Minneapolis, near where I work, the school teacher’s union managed a pension fund that recently failed and taxpayers and other school districts were forced to cover the overblown ill-managed pension plan. Now many counties, states, and federal agencies are suffering from the same problem. Plans that were “guaranteed” turn out impossible to guarantee when taxes get raised so high as to start bringing negative returns.

The First Step is to Admit that Traditional Pension Plans are a Fiction

They are based on expansion, but municipalities stop rapid expansion as they age. They are often invested in the stock market, which is unreliable. They are backed by “law,” but even the power of government force is not strong enough to squeeze that much blood from a turnip. Laws are not guarantees, they need sustainable fiscal plans to work. The maturation of society has to grow beyond such speculative retirement schemes and provide more genuinely honest pension plans to employees. The political promises of past generations have come home to roost. We must admit that these plans cannot be guaranteed. Like other “entitlements,” they can only be backed by existing funds, not hoped-for funds.

These plans that exist should not be considered guaranteed, and the law ought not recognize them as such. Such plans ought to be continued as payouts based on the performance of the entire pension fund, rather than an absolute monthly guarantee. Otherwise such plans ought to be converted to private 401ks or annuities.

It is immoral to speculate with other people’s money, especially without their permission. What Enron did to its employee pensions was not technically illegal, but it was immoral. The laws regulating corporate and government pension plans ought to be brought into conformity with basic moral principle that it is wrong to promise something you cannot guarantee. Since institutional funds affect many people, good governance requires strict accounting that forbids fund managers to speculate with such funds haphazardly.

The Second Step is to Adopt Privately Managed Plans

Corporations have largely adopted 401k plans, which allow the retiree to decide whether he will entertain a personal risk on the stock market, or whether his retirement funds will be invested in other financial instruments. This shifts the risk from the employer to the retiree, which is where it should be.

Another option is an annuity. Annuities are the safest financial instrument that exists that can guarantee a fixed payment for retirement. This is why Ben Bernanke and others who want a guaranteed return they can count on choose them. It is not that the people who work in insurance companies are any less tempted to speculate with large pools of money than government bureaucrats or bankers, but that annuities are highly regulated and they must retain enough assets to back the obligations that are payable. By law, they cannot simply decree that the future will take care of itself as so many fund managers are inclined to do.

Some governments, like Orange County, California have begun to move in this direction. Government employee unions are naturally resistant, but their expectation that they can demand something that can’t be promised is unrealistic and should not be allowed to stand in court. The world doesn’t work that way. The best way employers, whether government or private, can serve the pension goals of employees is to pay into private plans that are well-regulated and safe while the employee is drawing a salary and encumber no further obligation that will cause future budgets to collapse.

The American public is on its way to reaching a consensus agreement that the vision of financial retirement security is in reality an unattainable dream. Pensions once backed by industrial fortunes have run their course. They became obsolete and folded. In their place two kinds of retirement security were created. One for the average citizen – social security and another separate retirement fund for the employees of the state. Over time, as this article points out, the dream of government backed pensions were well intentioned yet nonetheless, they were ill conceived and turned out to be a poorly managed sham akin to a federally run ponzi scheme. A fiction perpetuated by willfull public ignorance, snake oil and aggregious political slight of hand. Sadly, we have no one to blame but ourselves for failing to heed the warningsT of economists for decades. Like passengers who purchased tickets to travel on the retirement bus, we are now facing the prospects of having to step off the bus and walk. Astute retirees will fall back upon private savings. Some people will perhaps make the retirement journey by hitchhiking with relatives. However, many millions of the baby boom generation face an uncertain and worrisome future. The times have changed. Saving for retirement shall now be defined as an individual responsibility. A few dollars set aside every week over a lifetime would be entrusted in 401K investment accounts. Hopefully with the assurance that the banks will fullfill their fiduciary duties to protect and grow the investments without risk. So, can the public be assured that the financial collapse of 2008 will not be repeated again in the future ? Are such safeguards even possible or will it be business as usual?

Two Points need to added to this analysis:

1) It has been said recently that over 30 states are so far in debt that they will either a) seek a federal bail out (no mas!) or b) severely cut essential services, causing further disruption and loss of trust. Another option – if congress would pass a law making it possible – is to declare bankruptcy and force the public employee unions back to the table to restructure wages and pensions to a sustainable level. As stated, times have changed and past guarantees cannot be met. Simple fact.

2) It is a misnomer to label 401(k) accounts savings; they are investments and they are at risk, as we have seen. If people must save and be responsible for their own retirement, as they should, it is time to return to the basics. One such form that has been around for 200 years is Mutual whole life insurance and it is making a comeback. Designed properly, it can be a powerful vehicle for accumulation and control of assets.

Yes, 401k accounts are investments with a percentage in the stock market. Many public pension funds are the same. There is no reason for retirees or the government to expect or provide any guarantees on such accounts as they are speculation, a form of gambling.

If you want an absolute return on investments, they must not be based on speculation. Government bonds are as good as a government. That used to be considered sound, but there is also some risk that governments will go bankrupt because many governments provide poor fiscal management, relying on the power of taxation to repay rather than sound fiscal practices. However, you cannot get blood out of a turnip, and relying on force the create economic stability is also a form of speculation.

I mentioned annuities in the article, not only because Ben Bernanke relies on them, but because they are based on cash reserves or equivalents adequate to pay out the life of the annuity. This is like having cash in the bank. It is not based on speculation but sound, and heavily regulated, actuarial principles.